- La Feria Community Holds Succesful Business Mixer Event

- Little Nashville to Take Place in Downtown Mercedes

- Lions Basketball Captures District Gold

- La Feria ISD Students Compete in Regional Chess Tournament

- Lions End First Half of 32-4A on a High Note

- La Feria ISD Held Another Successful Parent Conference

- Strong Appearance for Lions at Hidalgo Power Meet

- LFECHS Students Get to Meet Local Actress

- Students Participate in Marine Biology Camp

- Two LFECHS Students Qualify for All-State Band

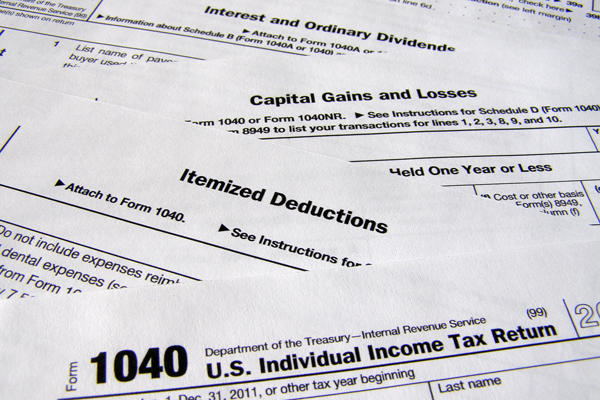

Tax Time in Texas: Organize Now or Scramble Later

- Updated: January 27, 2015

by John Michaelson/TNS

AUSTIN, Texas – It is still more than three months away, but Texans are being urged to spend a little time now to get ready for the upcoming income tax-filing season.

Luis Garcia, a spokesman for the Internal Revenue Service, says by locating and organizing all your important tax documents early in the process, you won’t be scrambling to find them when the April 15 deadline is looming.

Financial advisers say now is the time to start planning and getting organized, so you’re not caught in a pinch at the April 15 income tax-filing deadline. Photo: Chris Potter/Flickr.

“That means if you’ve got Form 1099s from your bank, or you have your W-2 from your employer, you want to make sure that all those documents end up in the same place,” he advises. “Now, whether it’s a shoebox or a folder – that’s really the most important thing.”

More detailed information, forms and publications are online at IRS.gov.

Garcia also notes this is the first tax season in which the Affordable Care Act figures heavily, which could mean a little extra paperwork for those who gained coverage.

“The people who purchased health insurance, they want to be on the lookout for Form 1095A,” he points out. “And that’s the form that you’re going to use to make sure that you get the credit that you need, in order to make sure that you’re getting your health insurance covered properly.”

Garcia adds there also is a form to fill out for anyone who received an exemption to the health insurance mandate for 2014.